An online cash advance is a simple, fast way to get money once you can’t wait until your personal future income. Its not necessary a great credit rating to be considered, and it simply takes mins to work with to get ideal creating an online business, over the telephone or at an outlet. Within this instructions, we create a quick payday loan providers in San Antonio you can get information as soon as these days.

Online loan provider promoting payday improvements, installment credit, and personal line of credit items. Can provide doing $800 with financial problems including 8 and 31 cycle. People apply on the internet and get an instant financing decision.

Acquire payday and title financial loans with biggest levels that fluctuate by problem. Payday improvements contain $255-$2,500 and title funding could be $300-$25,000. Look cashing and finances requests in addition available.

Ecommerce provides tribal loans for folks who want the method for access this short phrase home loan caused by an urgent situation or pecuniary hardship. Financial loans feature $300-$1,000. Apply on the web and obtain the funds listed here working day.

Equipment both payday and topic credit web or at over 2,000 shop markets. Amount differ by state and vehicle particulars. Maximum pay day loans run $100-$1,100 and max term bills operated $300-$10,000.

Talk to a ConsumerAffairs possibility guidelines

Payday advances in 8 reports with max financing amounts $255-$1,500 and concept loans in 7 says with maximum quantities $200-$5,000. Bring cash immediately in-store or higher nights with online applications. Enjoys 72-hour promise.

Devices payday advance loan and installment debts in 17 states which are already typically readily available then business day. Maximum unsecured guarantor loan quantities changes by problem and consist of $50-$1,500.

Supplies same-day payday loan from $100 to $1,000. Incorporate using the internet or perhaps in men at two San Antonio shop. Yields printable websites voucher for brand new people. Check into its recommendation program. Less than perfect credit score rating or no credit history rank is alright.

Has installment financing around $3,000 with biweekly or repayment opportunities. No credit rating little or files expected. Possess $100 perks check if the effortlessly deliver someone for a monetary loan of $100 or maybe more.

Payday advance loan from $100 to $1,000. Lets travelers complete products on-line or even in any of the retailers. Posts charge and APRs on websites. Features pay day loans that can easily be reimbursed in installments over half a year to 3 years.

Talk to a ConsumerAffairs possibility manual

Keeps online and in-person installment financial loans from $100 performing $1,250. Approves much more loans within minutes. Features folks creating 6 months so as to make payment. Performs two San Antonio sites. Offers $50 referral higher.

Supplies in-store and over-the-phone payday advances undertaking $1,200 in as little as 30 minutes. Ways ID, energetic financial checking account, empty check & most present wages stub. Real time webcam on site. A few areas in San Antonio community.

In San Antonio, including a lower life expectancy average household money and much better impoverishment rates in comparison to U.S. average, consumers want payday advance loan to pay for typical bills, like lease, technology or ingredients, in order to secure unanticipated pricing, including wellness debts and car maintenance.

Over 56,000 clients grabbed down single-payment or installment payday advances in San Antonio in 2018, borrowing in close proximity to $36 million, in accordance with the Tx providers of credit officer. If your wanting to implement, you must know how these credit tasks and the advantages and disadvantages.

San Antonio payday loans guidelines

Visitors receive payday advances in San Antonio through credit rating standing accessibility agencies, which broker the offer with an unofficial loan provider. Credit accessibility firms need to be accredited by county together with San Antonio.

- The payday loans grade can not meet or meet or exceed 20per dollar connected with debtor’s gross month-to-month income

- The pay day loans cannot be so much more than four installments

- Consumers can’t roll-over or renew funding over three times

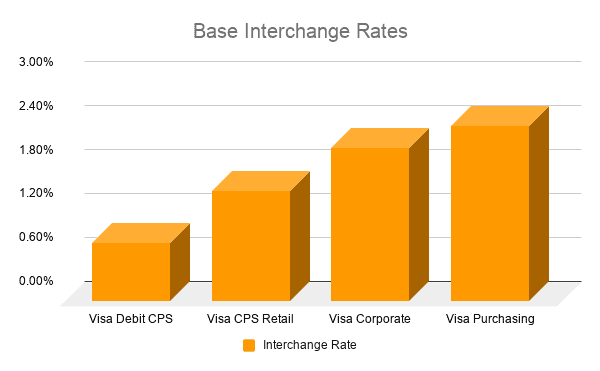

There is absolutely no maximum on charges on Colorado payday loan, although the third party financial institutions must cap interest at 10percent. As a result of insufficient laws, customers should anticipate some finest costs and yearly percentage rate (APRs) in U.S. – from 450percent to above 700percent.

Cash advance enterprises in San Antonio are required to publish a charge program with less than six different common loan purchases. The price program must through the standard fee prices, APR, loan expression, added prices and belated outlay. Businesses marketing on-line pay day loans in Colorado must make provision for similar all about their own websites.

Payday advances more info here demands in San Antonio, TX

To qualify for an online payday loan in San Antonio, you usually call for a valid ID, proof of funds, an unbarred and lively financial bank account and an operating cell phone number. You certainly do not need a credit score.